Yellowstone County Property Owners

2026 Tax Information for Montana Property Owners

Reduced Tax Rates for Primary Residences and Long-term Rentals. The Montana Department of Revenue will implement a new tax rate structure in 2026 that reduces ...

https://revenue.mt.gov/property/property-tax-changes/2026-property-tax-informationThe Treasurer's Office is Currently Located ...

2025 Real Estate second half tax payments are due in the Yellowstone County Treasurer's Office or postmarked by 5:00 pm, May 31, 2026. June 1, 2026 ...

https://www.yellowstonecountymt.gov/Treasurer/Yellowstone County, Montana

... property and the new owners of your old property will display as normal. ... Copyright 2013-2026 Yellowstone County, Montana. All Rights Reserved ...

https://yellowstonecountymt.gov/treasurer/propertysearch/csaprop.asp?propid=215359Treasurer: Yellowstone County taxpayers could be on hook ...

Yellowstone County property owners could see an increase on their property taxes ... 2026 and 2027. Christman said the issue caught him by surprise. "I feel bad ...

https://www.ktvq.com/news/local-news/treasurer-yellowstone-county-taxpayers-could-be-on-hook-for-schools-shortfallTreasurerDelinquent Property Tax Information

Official site for Yellowstone County, Montana. Find information on property records ... Copyright 2013-2026 Yellowstone County, Montana. All ...

https://www.yellowstonecountymt.gov/treasurer/propertysearch/csadelin.asp?propid=A01196&pidate=1/19/2026PROPERTY TAX OVERVIEW

The account administrator holds the monthly payments and remits the taxes directly to the county treasurer by the statutory due dates. 2026 ...

https://archive.legmt.gov/content/Publications/fiscal/2027-Biennium/Publications-and-Libraries/Libraries/Property-Tax/Property-Tax-Overview-2025.pdfLawsuit challenges Montana's second-home tax News

All three say in their court filing that it increased their 2025 property tax bills or will raise their 2026 tax rates. “I've heard from many of ...

https://www.bozemandailychronicle.com/news/lawsuit-challenges-montanas-second-home-tax/article_1fd10756-6226-465c-8851-3f5af2fc6dd1.htmlTax Relief for Homesteads and Long-term Rentals

Under Montana Law (15-1-802, MCA) all tax payments equal to or greater than $50,000 must be made electronically starting January 1, 2026. Tax Relief for Homesteads and Long-term Rentals See if you qualify today Below is a summary of changes to Montana's Property laws for "homesteads" and long-term rentals.

https://revenue.mt.gov/property/property-tax-changes/homesteads-and-long-term-rentals

Consolidated Yellowstone County Zoning Commission meeting of Thursday, January 8, 2026 Billings Planning & Community Services Department Facebook

Consolidated Yellowstone County Zoning Commission meeting of Thursday, January 8, 2026...

https://www.facebook.com/BillingsCityCountyPlanning/videos/consolidated-yellowstone-county-zoning-commission-meeting-of-thursday-january-8-/1601467217757948/

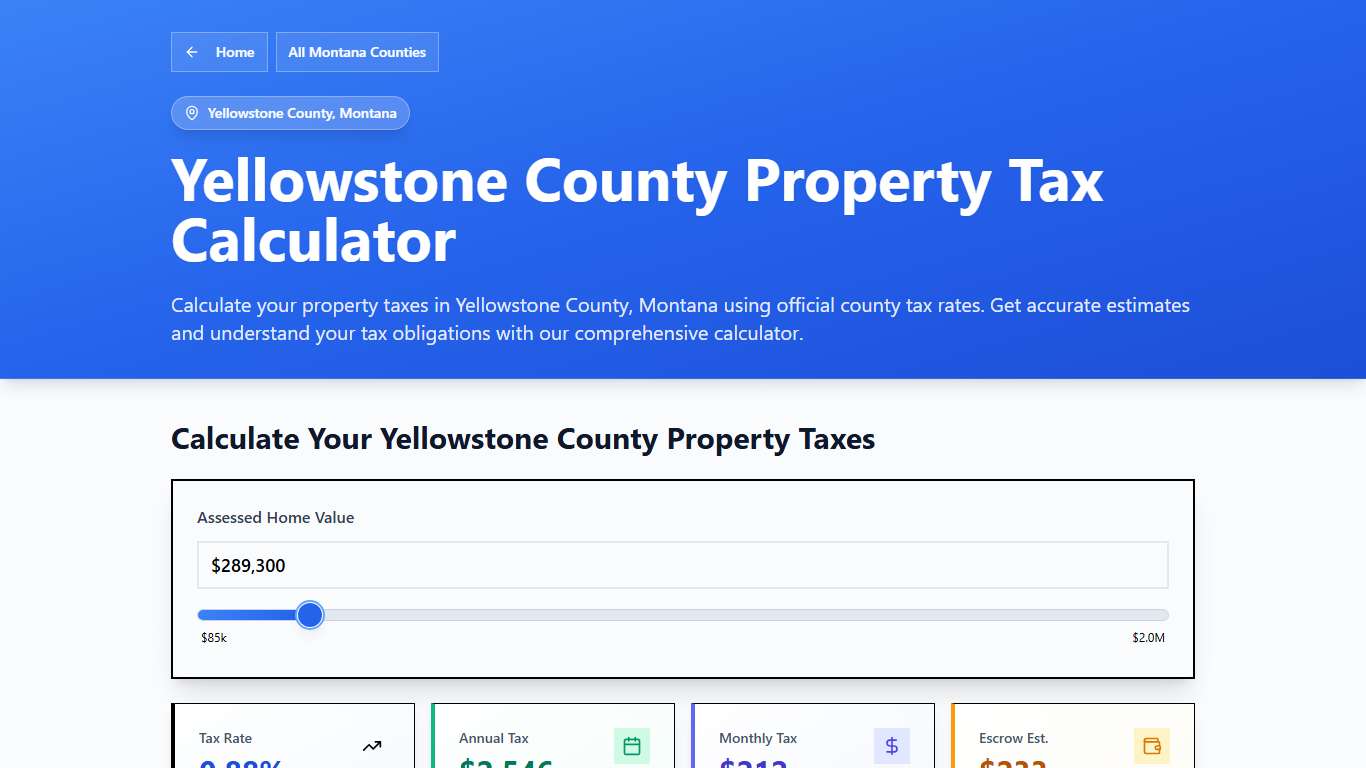

Yellowstone County, MT Property Tax Calculator 2025-2026

Calculate Your Yellowstone County Property Taxes Yellowstone County Tax Information How are Property Taxes Calculated in Yellowstone County? Property taxes in Yellowstone County, Montana are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.88% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/montana/yellowstone-county

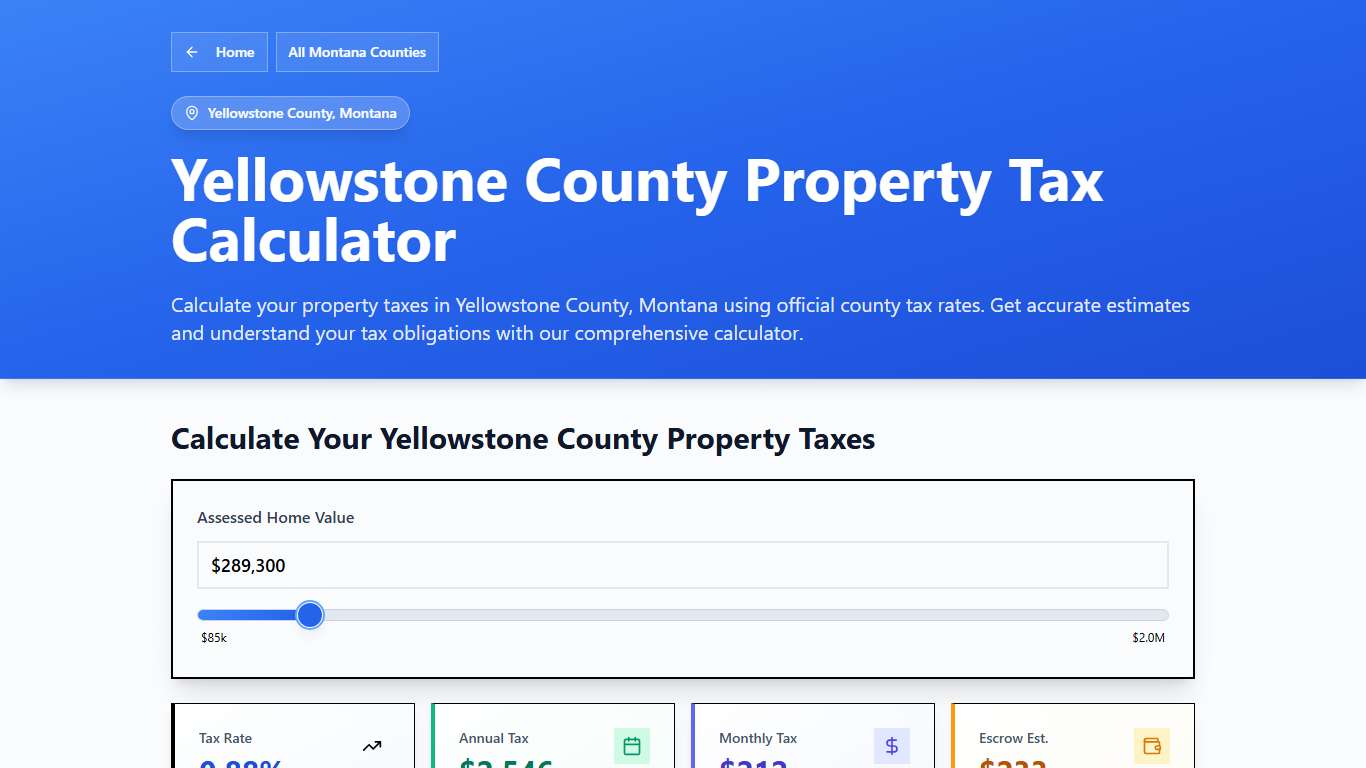

Yellowstone County, MT Property Tax Calculator 2025-2026

Calculate Your Yellowstone County Property Taxes Yellowstone County Tax Information How are Property Taxes Calculated in Yellowstone County? Property taxes in Yellowstone County, Montana are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.88% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/montana/yellowstone-county

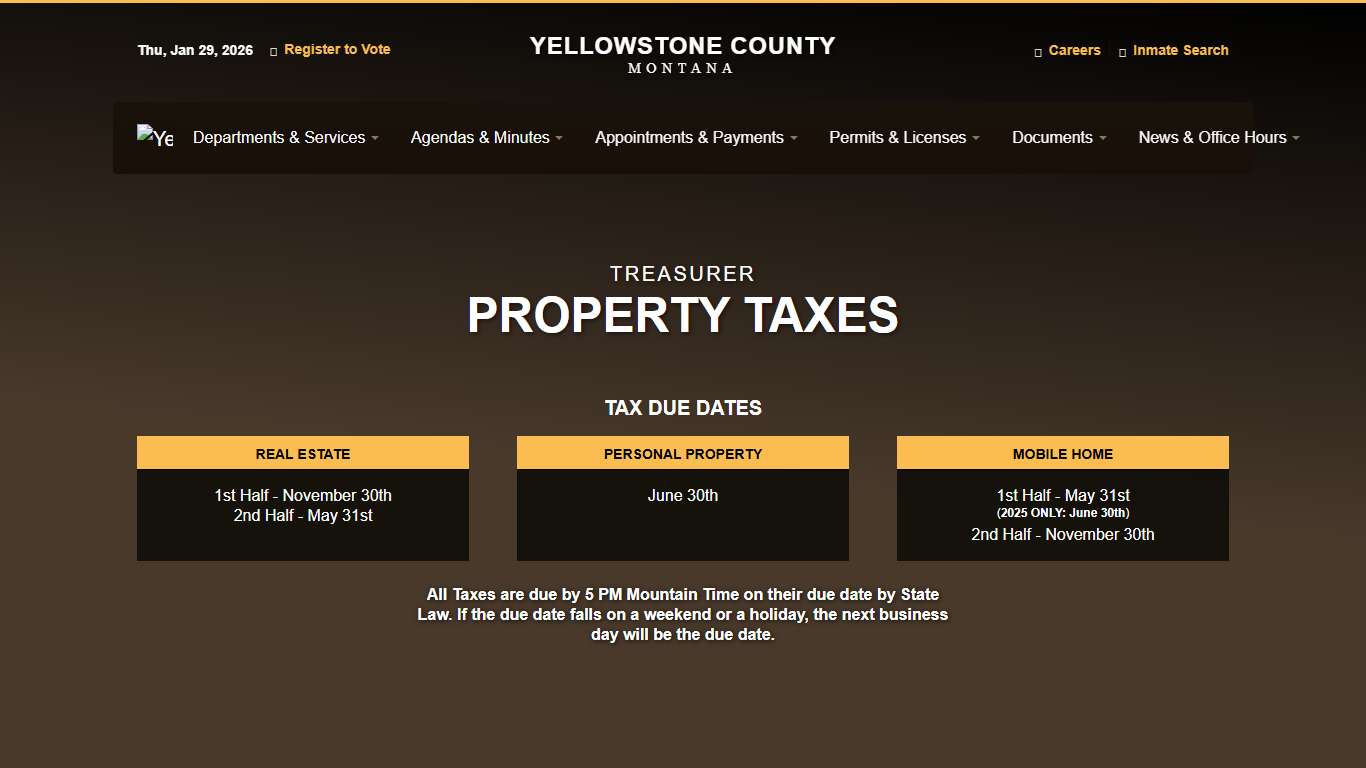

Treasurer

TreasurerProperty Taxes Tax Due Dates 1st Half - November 30th 2nd Half - May 31st June 30th 1st Half - May 31st (2025 ONLY: June 30th)2nd Half - November 30th All Taxes are due by 5 PM Mountain Time on their due date by State Law.

https://www.yellowstonecountymt.gov/Treasurer/property-taxes.asp

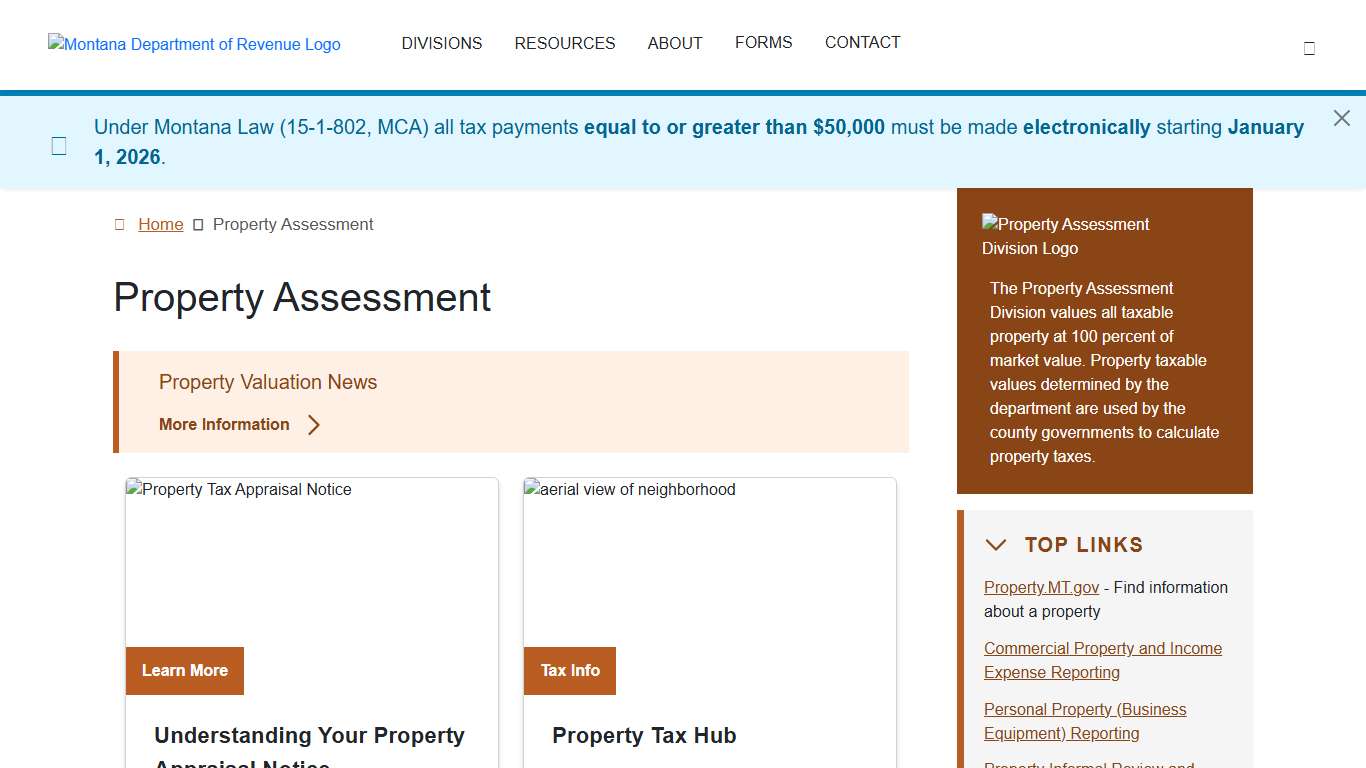

Property Assessment

Under Montana Law (15-1-802, MCA) all tax payments equal to or greater than $50,000 must be made electronically starting January 1, 2026. Property Assessment Property Valuation News For the 2025-2026 property valuation cycle, all real property is valued as of January 1, 2024.

https://revenue.mt.gov/property/

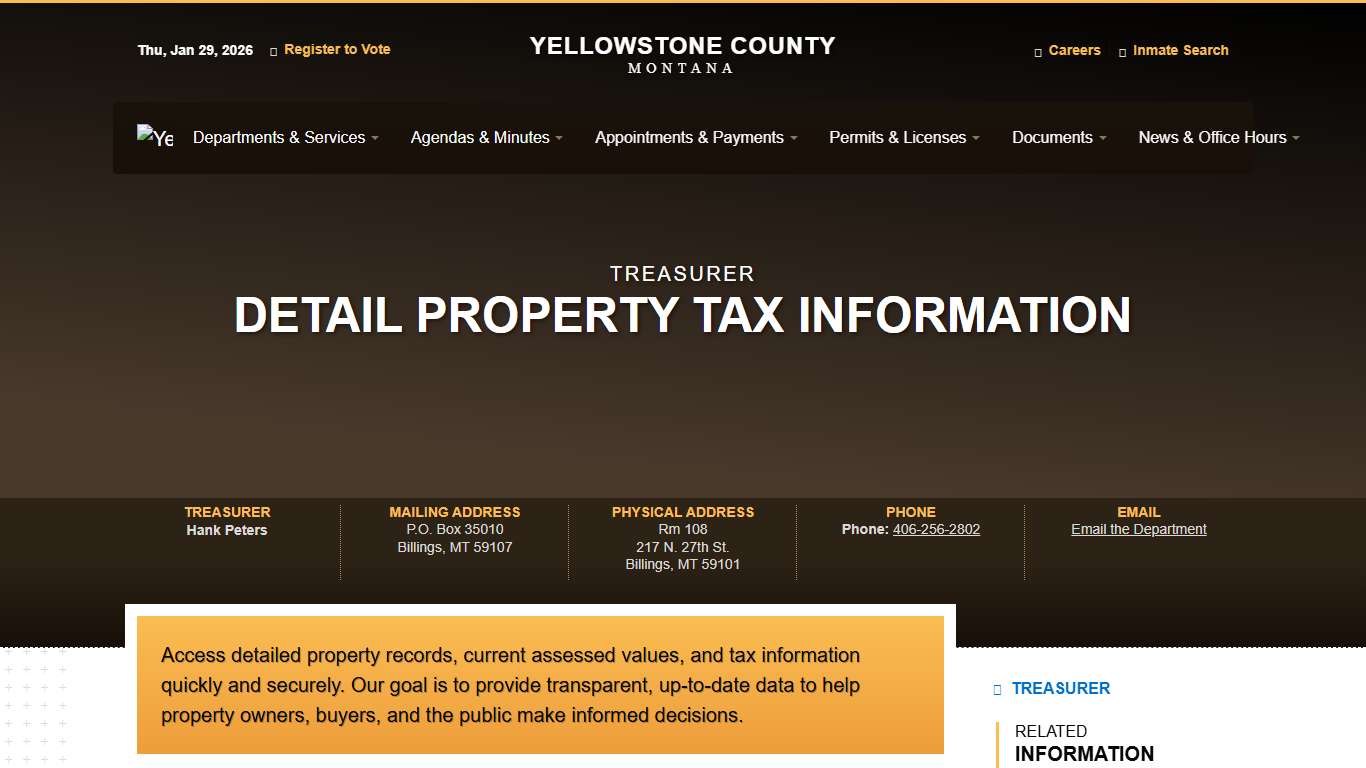

Treasurer

TreasurerDetail Property Tax Information Access detailed property records, current assessed values, and tax information quickly and securely. Our goal is to provide transparent, up-to-date data to help property owners, buyers, and the public make informed decisions.

https://www.yellowstonecountymt.gov/Treasurer/PropertySearch/csatydet.asp?propid=C08859&lyear=2016

Yellowstone County, Montana

The 2025 first half Real Estate tax payments are due in the Yellowstone County Treasurer's Office or postmarked by 5 pm November 30, 2025. December 1, 2025, interest will be assessed at the rate of 5/6 of 1% per month until paid and a 2% penalty will be assessed the day the taxes become delinquent.

https://www.yellowstonecountymt.gov/news-alerts.asp?id=21

Christi Jacobsen - Montana Secretary of State - Official Montana Secretary of State Website - Christi Jacobsen

Secretary of State Christi Jacobsen announced a new statewide campaign to recruit poll workers for the 2026 Primary and General Elections, continuing her efforts to support county election offices and strengthen Montana’s election workforce. Welcome to the official website 321,000+ Business Registrations 769,000+ Registered Voters — Thank you for doing business in Montana!

https://sosmt.gov/

Farm Service Agency (FSA) Farm Service Agency

Getting Started Are you new to farming or ranching? Or new to working with FSA? Are you new to farming or ranching? Or new to working with FSA? We can help you get started or grow your farming operation through a variety of programs and services: - Use the Program Finder to explore loans and other financial assistance - Our Loan Assistance Tool is a step-by-step guide to choosing a...

https://www.fsa.usda.gov/